Credit Score 101

Your credit score is a three-digit number that can help you unlock financial security. On the flip side, a low credit score can prevent you from getting what you need to take the next step in your life. In this article, we’ll answer all of your questions about your credit score such as what is the highest credit score and how to increase your credit score.

Credit Score Basics

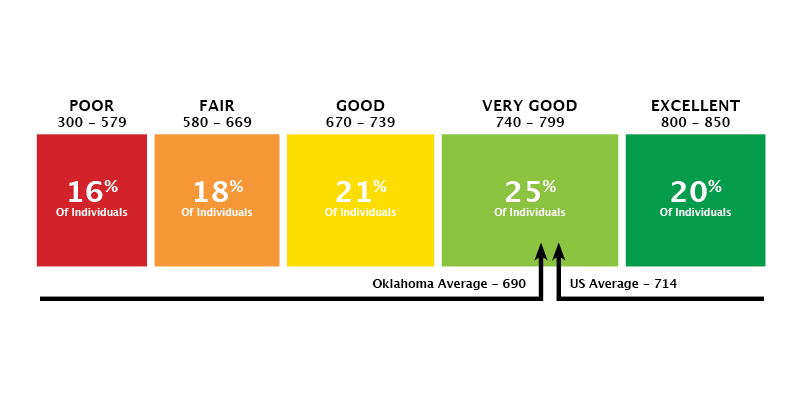

Nationwide, the average credit score is 714. Here in Oklahoma, the average is a little lower at about 690. But what does that mean? Learn what a good credit score is, the ranges for credit scores, and how your score is calculated.

What is a credit score?

A credit score is a three-digit number that reflects the creditworthiness of an individual. It is used by lenders to determine whether an individual is a good candidate for a loan. A good credit score indicates that an individual is likely to repay a loan. A bad credit score indicates that an individual is likely to default on a loan.

Credit Score Ranges

- Excellent: 800 to 850

- Very Good: 740 to 799

- Good: 670 to 739

- Fair: 580 to 669

- Poor: 300 to 579

How is your credit score calculated?

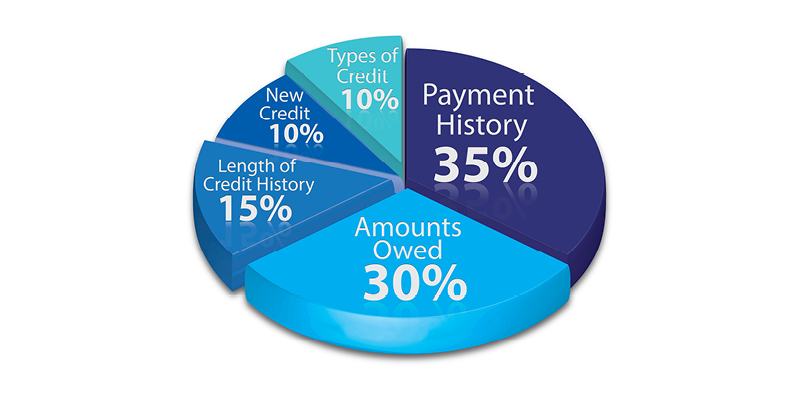

There are three primary credit reporting bureaus: Experian, Equifax and TransUnion. Each credit scoring model calculates risk differently, which results in score variations depending on the model the credit bureaus use to calculate your score. However, the main factors in every credit scoring model include:

- Payment history: Make sure to pay your bills on time so a late payment history doesn’t drag down your score.

- Credit Utilization Ratio: This is the portion of your total credit limit (across however many credit cards or lines of credit you have) that you’re currently using (i.e. your current balances). Keep your credit utilization rate below 30% for the best affect on your score.

- Credit mix: Do you have different types of credit accounts, such as term loans as well as credit cards and lines of credit? A good credit mix shows that you can handle multiple account types responsibly.

- Length of credit history: Measures the length of your total credit history as well as the age of your oldest credit account. We recommend leaving your oldest credit card account open because that will help you with this part of your credit score.

5 Benefits of a Good Credit Score

So, why do you want to maintain at least a good credit score?

- You're more likely to be approved for loans and other new credit accounts. For example, mortgage loans have different minimum credit score requirements. Call a member of our mortgage team today to get current requirements and other important information.

- You're more likely to get the best possible interest rate. When it comes to most loans the better your credit score is, the lower your rate will be, which means you save money.

- You're more likely to be approved for new credit card accounts. Whether you’re applying for your first credit card or your next one, a good credit score will help your application get approved and can affect the interest rate you receive on purchases.

- You're more likely to get lower home and auto insurance premiums. Insurance companies use information from your credit report and insurance history to develop your insurance risk score.

- It’s easier to rent an apartment. Most landlords and rental companies will want to do a credit check on you before approving your application for a rental home. If your credit doesn’t fall into the range they’re looking for, you may need a co-signer or have to pay a larger security deposit.

9 Ways To Improve Your Credit Score

Does your credit score fall in the poor to fair range? Not to worry–use as many of these strategies as you can to boost your score over time.

- Pay your bills on time. If you need help remembering due dates, enroll in auto pay or use our Online Bill Pay service to schedule payments in advance.

- Catch up on any past-due accounts. Call the companies or creditors you’ve fallen behind on paying. They may be able to offer you a special payment plan to get back on track.

- Keep your debt balances low. Credit utilization is a big factor in calculating your score. Getting that number to below 30% can deliver a big increase in your credit score.

- Ask for an increase in your credit limit. This is another way to lower your credit utilization–by increasing your total available credit.

- Only apply for credit you need. While it can be tempting to save money on a purchase by opening a retail credit card or airline credit card, you’re better off in the long run by only having the credit accounts you need.

- Don't apply for too many new credit accounts at once. If you go on a spree of loan or credit card applications, it can be interpreted as a sign of financial distress and temporarily lower your credit score.

- Keep your oldest credit accounts open. It’s a good idea to charge at least one purchase a month, such as gas or groceries, to keep your oldest accounts open and active.

- Check your credit report for inaccuracies or signs of identity theft and fraud. If you find anything suspicious, contact the credit reporting bureau immediately.

- Take advantage of credit score-boosting programs such as Experian Boost and UltraFICO.

Read a Deeper Guide on How To Improve Your Credit Score

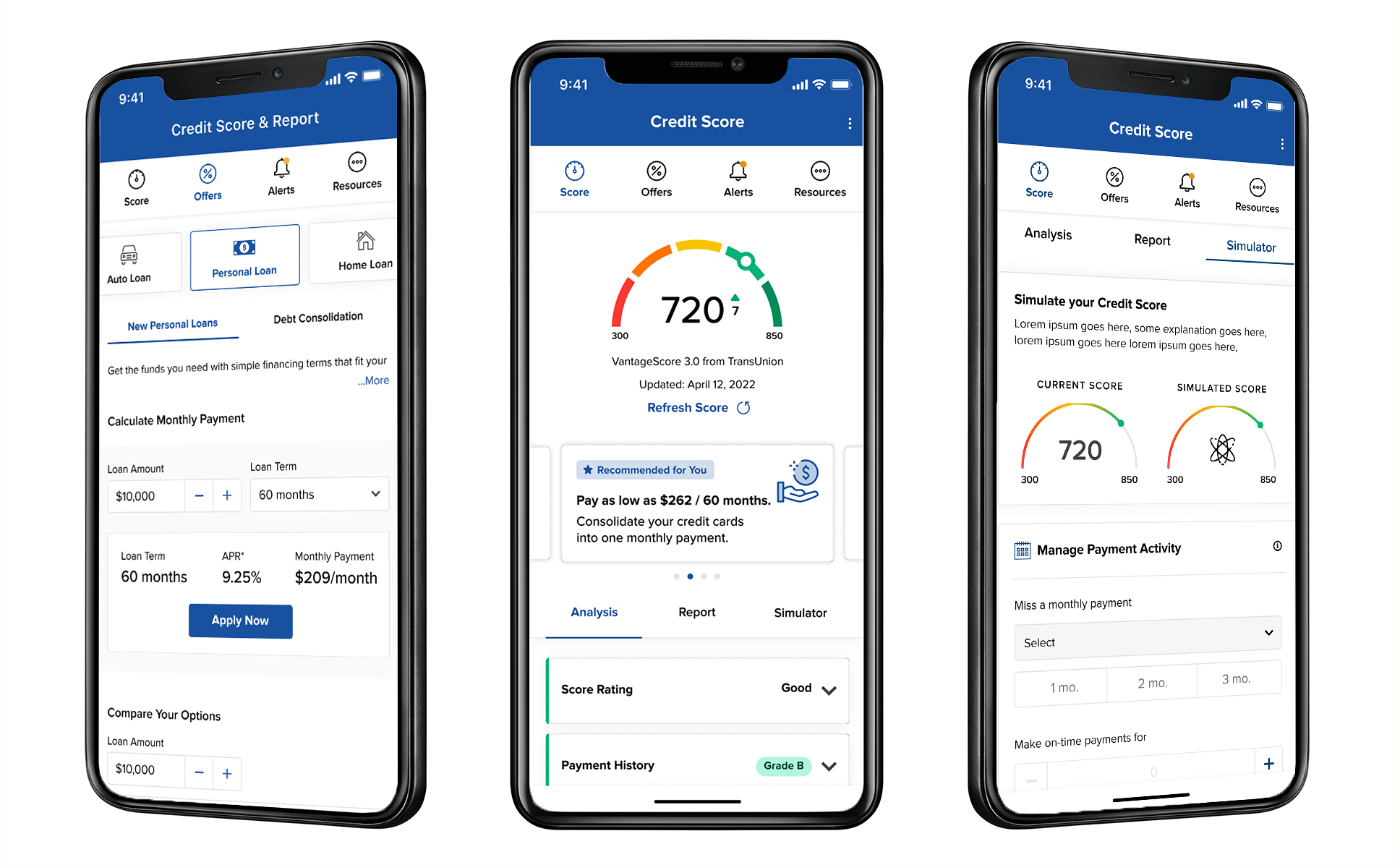

Take Control of Your Credit with Help From F&M Bank!

Working to improve your credit score has benefits no matter your age or stage of life. Understanding how your credit score is calculated when you are young can set you up for a lifetime of success. Raising your credit score to the next tier could save you thousands of dollars when buying a home and applying for a mortgage. That’s why we are excited to offer a free credit monitoring service to all of our customers. All you need to do to take advantage of “Credit Score” is download our app and follow the instructions. Take control of your credit history and score today!